How Loom’s founders pivoted 2x to figure out what to build for teams

In 2015, three friends decided to use their complementary skillsets to build something together - and avoid returning to full-time jobs. They rapidly iterated through three products in just 9 months to land on Loom, a video messaging platform for improving work communication.

But rather than following a common recommendation, “niche down even more,” they aimed to get pretty much everyone within a workplace to use their video recording tools.

With no Ivy League educations and no big name corporate backgrounds, founders Joe Thomas, Vinay Hiremath and Shahed Khan used constant user input to hone their concept, prove value, and build a platform valued at $1.53 Billion with 14+ million users worldwide.

The 0-1 Timeline

Loom’s founders focused on finding key insights from the very beginning. They started with realizations about a growing market, then shipped their first product to ProductHunt for qualitative feedback, fast.

They first launched a 2-sided marketplace product, OpenTest, on ProductHunt in September 2015. An initial spike in usage quickly died off - a signal to them that this idea wasn’t sticky enough.

Let’s take a look at exactly how they dug for the feedback and insights that led to multiple pivots, and eventually Loom’s success.

The Discovery Steps

Here are the ways the Loom founders started understanding who their best users were, what to build for them, and how to get them to pay.

📈 1. Starting with a growing market trend. Video was the fastest growing sector of internet traffic at the time. It was frequent in consumer apps like Snapchat and Youtube, but there was no video (yet) in workplace communication.

🏞️ 2. Reviewing the landscape of user testing platforms, they noticed no one was enabling expert feedback on work-in-progress products. Plus, they thought platforms like usertesting.com were “antiquated.”

📦 3. Launching an early MVP of their testing and feedback platform, OpenTest, to ProductHunt. There was some interest, but no virality. But they had 1-on-1 conversations with early users.

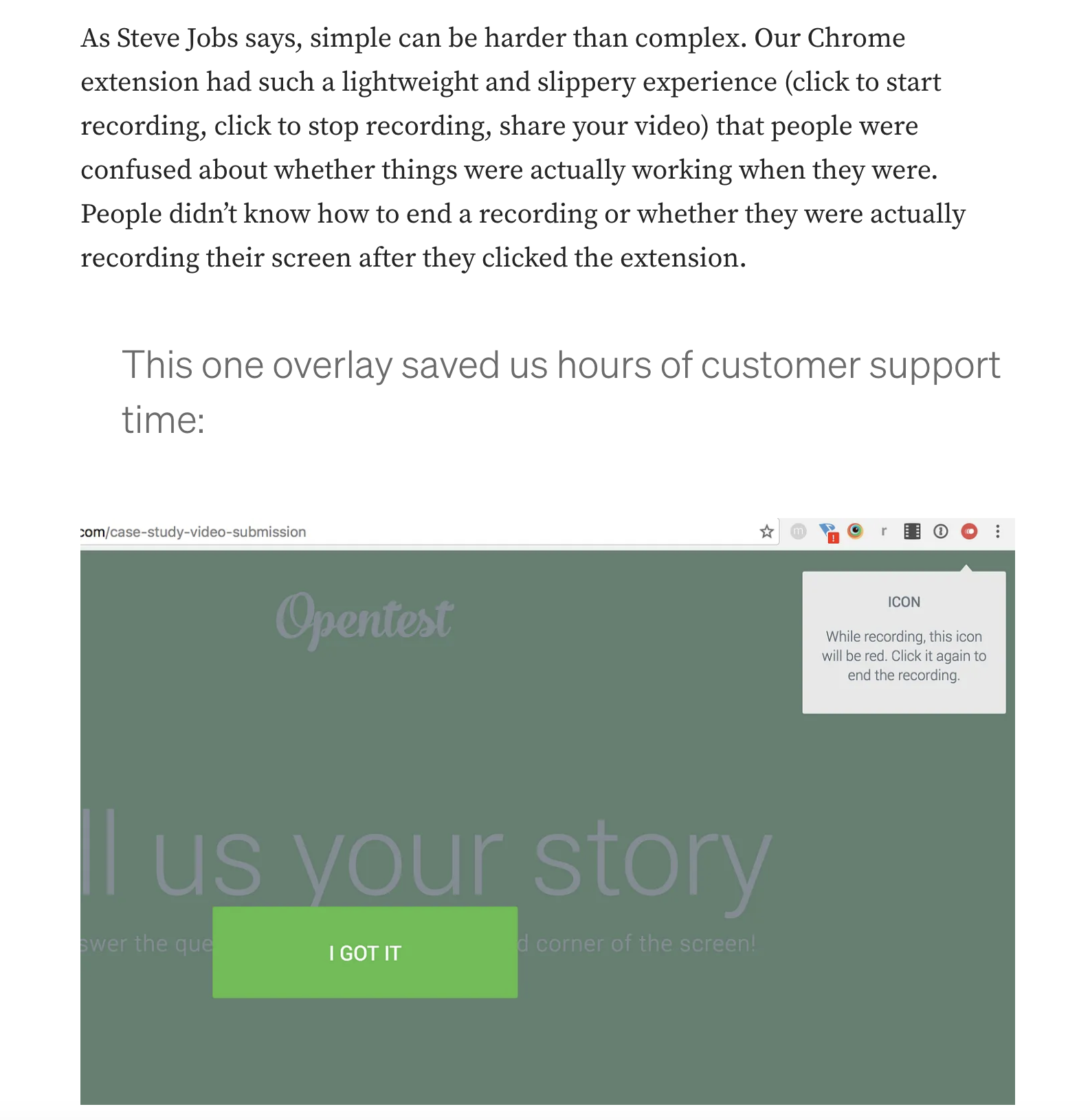

👩👦 4. Iterating to help companies test their products with their own users, not “experts”. They starting homing in on a better target audience that might be able to pay for a product, and design for them. They ran fast coffee shop testing and fixed usability issues pre-launch on ProductHunt.

✂️ 5. Finding the “atomic unit” of customer value in the video recorder plus face bubble. They followed user input again to find that video recording was the source of real value - and made it a standalone product.

🙋 6. Surveying customers within 30 days of the OpenVid re-launch as video recording only. They aimed first to understand who was using the product, and how, and got clearer on their audience.

🧑🎓 7. Collecting feedback from the first 1000’s of users for ≈6 months. They spent this time rapidly iterating to improve the core value and figure out what users wanted.

🐶 8. Dogfooding their own product. They became power users of Loom with a remote-first work setup in order to test and use the product as much as they could.

🚧 9. Focusing on performance features and delight. They realized a big blocker to use was the discomfort of recording oneself. They worked to make this more comfortable for new users.

🏡 10. Driving virality by keeping users on their most-used comms platforms instead of on Loom. Insights from early, scaling users told them not to optimize for Loom-based work, but to integrate Loom in other platforms.

💵 11. Customer Discovery for monetization, ≈3 years after first launch. Loom monetized between Q3 2018-Q1 2019 when they realized there features highly demanded that they could package as a new premium product.

🧑🔬 12. Beta testing the Pro tier to de-risk before public launch. They were 80-90% certain of their pricing and feature set, but ran a Beta with many users before launching publicly to fine tune.

Here’s how they ran each discovery step in detail

1. Starting with a growing market trend.

At the time, the founding team saw video everywhere in consumer apps like Snapchat and Youtube. But workplace comms were still entirely text-based.

They reviewed reputable trend reports like Mary Meeker’s and saw that video was actually the fastest growing sector of internet traffic.

“We had been using consumer apps like Snapchat and Youtube, and we felt like video was everywhere in the consumer landscape, but when we showed up at work, we were still using Outlook for email, and then it was Slack in the last 6-12 months before we started Loom. But video was truly nowhere to be found.”

Here’s how they found the starting insights -

Reviewed trends reports like Mary Meeker’s annual Internet Trends report, to see what the trends in media were

Thought about the consumer services they were using, and what was missing in the workplace - found the gap

Specifically considered where “exponential growth” might be. As founder Joe Thomas said, “it’s much easer to ride a wave than it is to create one yourself.”

A few questions and assumptions that came from this stage:

Assumption: People will be willing to use video to communicate in the workplace (and find it as valuable as consumers do)

Question: How can we bring a highly valuable, seamless video product to the workplace to jump on this new consumer trend and growing comfort with video?

2. Finding a gap in the landscape of testing tools

After scouring broad market trends, they looked at how early startups were testing products. And found another gap.

They thought platforms like usertesting.com were “antiquated,” and saw an opportunity to connect experts at big-name tech firms with startups that needed feedback on early works in progress.

A few questions and assumptions they had here -

Question: Can you have an expert network that gives feedback for micro transactions?

Question: How can we build a next-gen version of usertesting.com?

Assumption: Early stage startups don’t have experts in-house like experienced FAANG employees who can effectively feedback early pre-launch works in progress

3. Launching an MVP to ProductHunt.

With their first product, OpenTest, they wanted to give startups the feeling that they had access to experts from the world’s best companies.

Experts working at FAANG companies would give feedback on code, design files, product requirement documents, and more from early stage teams.

It was a 2-sided marketplace. Experts would get paid for feedback, and startups got feedback from experienced professionals.

How they built and launched their first MVP -

They had some experts at big tech companies in their network, and seem to have gotten them on board

At first, the process was manual. Experts needed to record a feedback video using Quicktime, then upload it.

The Loom founders would handle sending the video and payments manually behind the scenes. This is a Concierge test, or Wizard of Oz test, depending on whether they told the experts and testers that they were handling it all behind the curtain.

They added a video layer to make recording videos easier for the experts than Quicktime.

They launched the MVP on ProductHunt. They got some signups, but interest died pretty fast.

They gained valuable feedback from early users of their first product in 1-on-1 chats and conversations on various platforms. The Loom founders had at least 20 calls at this point

A few insights that came from this stage -

Insight: Videos took 15-20 minutes to upload - too much friction. They needed to make uploading faster and easier for this to work.

Insight: The small startups didn’t have the money to pay for the service.

Insight: The more mature startups and companies didn’t want to pay external product experts for something they felt their employees were already paid to do.

Insight: The organizations that could pay wanted real-time feedback from their own users. Of 20 calls, 5-6 of them specifically mentioned this need.

“...by putting a product in market, it makes a rich ecosystem to receive feedback from folks, and there might be golden nuggets of feedback that you want to keep pulling the string on.”

4. Iterating on feedback to enable testing with live users (OpenVid)

Based on feedback from OpenTest users, they repurposed their video recording function into a Chrome extension called OpenVid.

Companies could now use the extension to serve an NPS survey question to their website visitors or users. Depending on a user’s answer to NPS, they might get a prompt to leave video feedback in exchange for a product discount.

Companies could get feedback about the user’s experience, in real time, at key points of their product journey.

But before re-launching on Product Hunt, two of the founders spent a few days testing their MVP in coffee shops. They found a few painful usability issues and fixed them pre-launch.

Product #2: the Chrome Extension

From co-founder Vinay Hiremath’s post on OpenVid lessons

They made a couple of key assumptions based on the facts they had at the time.

They guessed that…

any company would only get a small percentage of their users to share feedback via the OpenVid Chrome extension

They knew that…

the companies that were most interested in the extension also had a high volume of website traffic

With high traffic, this user type was the most likely to generate hundreds of feedback videos without the Loom founders needing hundreds of business users.

More total recordings meant more data points, faster, for the Loom founders.

This is why they prioritized feedback from them, over others, and focused on the Chrome extension.

They got five or six companies with heavy website traffic to be early users of their Chrome extension. They kept in close contact with them for regular one-on-one feedback.

“You could think of it as like design partners, we had an ideas and we had the 6 companies that said they’d be interested in this, and we got 3 of them to sign up to do regular calls with us, in order to be like are we building the right thing, will you implement this on the website when it’s done?”

A few insights that came from this -

Insight: Their 5-6 early company partners and others wanted to record a video without having to record feedback on the website. They lifted up other use cases for the same technology that didn’t require the complex NPS surveying technology.

Insight: Users appreciated the front camera bubble showing a person talking while screen sharing. It made recordings more personal, and they didn’t have this function anywhere else.

4. Finding the “atomic unit” of value: video recording with a camera bubble

Another pivot! This time, they downscaled their offer to the single part with the core value users were demanding.

They decoupled video message recording from the testing platform. The functionality was simpler, but could be used for more workplace communication cases.

They saw stronger signals of user interest immediately.

Re-launching on ProductHunt, they got 3k signups within the first 36 hours.

They also saw traffic and usage increase 1+ day after launching, rather than dropping back to zero after a brief spike. They knew they’d nailed the organic virality that they’d failed to find before.

“Conviction is built through not just our intuition but also continuously having customer conversations where we weren’t prompting it, it was coming up naturally.”

The decision to reduce the feature set came from an assessment of effort vs. potential impact based on user feedback.

Cutting the video recording and camera bubble out of the test platform to offer it standalone was one of the easiest things they could do.

It also the had the highest demand among early users.

A few thoughts that came from this -

Observation: There was something more inherently shareable about video recording when used more broadly than confining it to user testing - though they didn’t yet know exactly what it was.

Assumption: There were potentially many workplace use cases where screen sharing with a front camera bubble could make communication more personal in distributed workplaces.

Exactly what they asked users:

When a user said they wanted the video recording alone, they would reflect their feedback back to them to check their understanding:

“Am I understanding this correctly? If you were to have [X], it would solve [THIS] pain point that you’re experiencing today?”

“You can’t impose your view of the world on them. You have to absorb their view of the world and then map your offering to that view, to the best of your ability.”

5. Surveying users in the first 30 days after OpenVid (Loom) launch

They were on Product #3 at this point. After relaunching OpenVid a second time as a standalone video recorder, they knew they needed to understand why and how they’d been more successful in order to continue on that path.

Within 30 days of relaunching on Product Hunt, they surveyed their few thousand early users.

They asked users about:

Their company size

Their role at work

Their work environment (remote/distributed team vs. on-site work)

They wanted to figure out precisely which users they should be building for.

But survey results revealed a wide spread of roles. They were Sales, and Marketing, and Engineering and everyone in between.

They didn’t want to niche down to serve only one role, and went against the typical advice.

Instead, they made it their mission to streamline workplace communication between roles and functions, rather than within a specific role or team.

A few insights and assumptions they gained from this stage:

Insight: Their early users were not just one type, they were spread across various roles, all using the video messaging tool for communication with both people in their teams and other companies

Assumption: They would maintain virality best if they could be a horizontal tool that served to help improve communication for multiple or all roles within an organization

“…we decided that we weren’t going to build Loom verticalized for Sales. We could have built a subset of features, we could have really targeted them, and gone after that vertical, maybe sold to Salesforce after a couple of years. But we felt like we had found an earned secret, and we wanted to build a horizontal communication collaboration app.”

6. Collecting feedback from the first 3k users for 6 months to prove increased activation

Spending six months focused solely on learning helped them pinpoint their most important metric.

It wasn’t when a new user recorded a video. It was sharing a video that mattered.

They decided a user wasn’t ‘activated’ until they sent the video to someone else.

In this period of intense customer feedback focus, two of three founders were constantly talking to users.

But all three were living together and discussing what they heard from users daily. They were fully immersed in customer feedback.

A few insights and assumptions they gained from this stage:

Insight: The most important metric was how many people shared a video after recording one

Insight: One of the biggest blockers of use was the discomfort many people felt with watching and hearing themselves recorded.

They were constantly in communication with early users across multiple platforms. Via co-founder Vinay Hiremath’s post

“[They prioritized building features] that were in the sweet spot of being the most requested from our users, scoped to our extension and website, and would genuinely be useful to ourselves as power users.”

8. Dogfooding their own product.

The team was growing, it was more than the three founders now.

But they realized that they needed to think differently about the team’s future. If the company were remote-first, they could test their own products for async communications constantly.

From this point, the next few hires they made were fully remote and the team used Loom daily.

In one of their earliest fundraising rounds, co-founder Joe Thomas even recorded pitch presentations and sent them to investors with Loom.

“When we were 5 people in an SF office/apartment, we ran a survey that found that 80% of our professional power users were using it to communicate with folks that they weren’t sitting right next to... So we knew that we had to dogfood that, and the next 5 hires we made were all remote, and we persisted that 50/50 split ever since.”

This sounds like Airbnb founder Brian Chesky becoming an Airbnb guest early on in their journey to build a superior experience, and later living out of Airbnbs for months to try it longer term. [Link to Airbnb post]

What the Loom team learned from this stage:

Insight: There are multiple new use cases where Loom can speed up the hiring process, such as in applications, candidate introductions and onboarding new hires.

9. Focusing on performance features and delight.

The product was gaining traction but there were still a few potential blockers to easy user acquisition.

They needed to continue to develop features for delight and performance, beyond the must-haves that other platforms could offer.

Many teams talk about the “aha moment” they try to get a user to experience early on. Loom’s founders saw that the first important aha moment was when a user experienced how much faster they could create a video with Loom than anywhere else. Speed was a critical metric across their development.

They also realized that many people hate to see and hear themselves recorded.

They prioritized testing features that would make recording more comfortable, like:

adding confidence-boosting messages and emojis when you recorded a video. Ex: “You look great today!”

playing video at faster speeds to save video recipients time, but also make the person recording sound smarter!

10. Driving virality by keeping users on their main comms platforms.

The Loom team wanted to fully understand how their tool was spreading both between organizations (inter-org) and within organizations (intra-org).

For the latter, they looked closely at teams adopting Loom most rapidly. Hubspot, for example, had spread Loom to 3,000 employees in little time.

They tracked how the CEO of Hubspot started using Loom, from finding the person who sent him his first Loom, and the path of expansion from there.

They wanted to pinpoint the value for the team, and how they could build better for companies like Hubspot for repeat success.

With input from Hubspot and other rapid-adopter teams, Loom realized they shouldn’t try to keep users in the Loom dashboard.

Keeping them in Loom didn’t improve users’ overall workflows.

They optimized for keeping Loom users sharing within Slack instead, and became the first video tool Slack welcomed as an integration.

This was yet another lever of growth from here.

What they learned from this stage:

Insight: Certain types of larger teams were virally expanding Loom use within the org in very little time. These were a great target audience to prioritize and optimize for.

Insight: Hubspot were already sharing a lot of links in Slack, and wanted to improve how they were sharing there, rather than leaving the platform to another dashboard.

11. Customer discovery for monetization, ≈3 years after first launch

The Loom founders specifically say they used pre-seed and seed money to invest in learning, not monetization.

They waited about three years to launch a product they would charge money for.

By then, they had a long list of feature requests with high demand, but which they didn’t want to build for free.

They used surveys and user conversations to build clarity around what to build in a new paid product.

How they tested willingness to pay and prioritized future paid features:

1. They ran a Feature Value Survey -

They had their list of features that users had requested over time

They showed 4 features per survey question. The user ranked the 4 features against each other, deciding what was most to least valuable for them.

Each feature ended up with a ranking on a scale of -4 to +4, based on the number of times it was selected by respondents.

The features that ranked above 0 were the ones they could charge for.

2. They also asked users Van Westendorp pricing questions in interviews. These are the questions -

At what price would you consider the product to be so expensive that you would not consider buying it? (Too Expensive)

At what price would you consider the product starting to get expensive, so that it is not out of the question, but you would have to give some thought to buying it? (Expensive/High Side)

At what price would you consider the product to be a bargain - a great buy for the money? (Cheap/Good Value)

At what price would you consider the product to be priced so low that you would feel the quality couldn't be very good? (Too Cheap)

Their aim was to get 80-90% of the way to confidence about pricing and feature set and then launch.

12. Beta testing the Pro tier.

I couldn’t find much about this phase, but I do know they invited up to 40,000 (!!) users to a Beta test of Loom Pro before sending it public according to co-founder Vinay Hiremath.

Based on what co-founder Joe Thomas said about getting to 80-90% of the way to pricing and feature-set confidence before launch, it sounds like the Beta test played a part in building that confidence - or it got them the last 10-20% of the way before public release.

How You Can Apply These Tactics 🗺️

Here are a few ways you can replicate some of the Loom team’s success.

Decide Objective #1 = Learning

The Loom founders pushed to learn as much as possible in the days - even hours - after anything they launched was live.

But they not only tried to learn fast, they focused on only learning for months. In the 6 months post-launch of OpenVid (which became Loom), the founders didn’t even take the time to rebrand despite that they knew they should. They were heads-down in feedback analysis, and knew that’s where their focus was better used.

Triangulate.

Early feedback was collected from both qualitative and quantitative sources. They were constantly comparing across both.

What did the signup data say was working after their ProductHunt launch? (Quantitative)

What did early users ask for and why? (Qualitative)

Where do the signals say the same thing? (Comparing)

The three founders were looking at feedback from slightly different lenses and comparing what they heard on a daily basis.

This is a solid way to make sure that multiple founders actually heard and interpreted the same things, and check the available “facts”.

Focus on Friction.

Friction is a blocker in any product’s adoption.

The Loom founders listened carefully to user feedback and looked for friction points from early on.

First, there was the difficulty of recording a video with Quicktime.

Then there was the slow upload speed of heavy video files.

Later, they heard about the insecurity of watching yourself in a video recording.

They understood that a smart idea can still fail if there’s too much friction. They chipped away at friction methodically by focusing on where users told them they felt it most.

Always hunt for the strongest emotional signals.

“People had to move from ideation of wanting to record to delivering the video in the fewest actions possible and with that we built the most stripped down version of our product:

- One click to record

- One click to end the recording

- Share the link we instantly generate with anyone”

Find value before charging money.

The Loom founders say they specifically focused on finding value for users before trying to charge for any of it.

It took them ≈3 years from founding to launch a premium product that anyone paid for, but by then, they had a deep understanding of their user base.

They first made sure they had fully vetted their concept and chosen the right direction before differentiating features that would cost.

Pivot early based on effort and signal strength.

The decision to move away from their OpenTest platform wasn’t an easy one.

They had 3+ paying customers and an investor who wanted to give them money, but only for OpenTest. They still chose to pivot.

You can copy their decision-making model by looking at two things:

Prioritize the concepts with the strongest signals from users.

They’d heard the same thing from enough people, and the responses were stronger than other feedback

Give an effort score to each of the ideas you’re considering.

The Loom founders decided to focus where they could address the user problem with least effort.

Focusing on only the recording with a camera bubble was by far the easiest thing to do of everything they had tried.

OpenVid was also growing naturally. It wasn’t as hard to grow as OpenTest was. Despite that the funding might be there for OpenTest, the struggle was, too.

Don’t avoid talking to users about pricing just because it’s not 100% reliable.

There are a lot of biases involved in asking customers what features they “would” pay for, and how much. Most of us just don’t know how we might behave in hypothetical situations.

But we can still gain more insight from discussing pricing with users than avoiding the topic entirely.

The Loom team seems to have gained valuable insight from surveying and talking to customers about features they would find most valuable, and the benefits that contribute to willingness to pay.

In my experience, even having an “imperfect” and somewhat biased interview with a customer about what they might pay for can be full of clues to what they value, where their strongest pains have remained unsolved, and how much they pay for other similar services. You might as well start somewhere, and learn as you go.

One more thing…

An important note about trust

From my perspective, the Loom founders were unusually committed to building trust with their users.

They specifically asked their early users if they were allowed to watch the videos they uploaded.

Even when someone contacted them for troubleshooting help, they asked first if it was okay for them to watch the video that had a problem.

Then they had a conversation about what they were doing in the video, what they were using it for…but all on the basis of trust and consent, first.